That’s the call made by analysts Janardan Menon and Om Bakhda who predict a 2% sales decline for ASML which manufactures machines used in semiconductor production, an estimate 17% below the street. At the same time, Jefferies lowered their recommendation on the stock to hold. Their target price for the stock is €690 while the average target of analysts contributing to FactSet is €767. Only one analyst, among more than thirty covering the stock, has a sell recommendation.

Jefferies also reduced its rating to hold on ASM

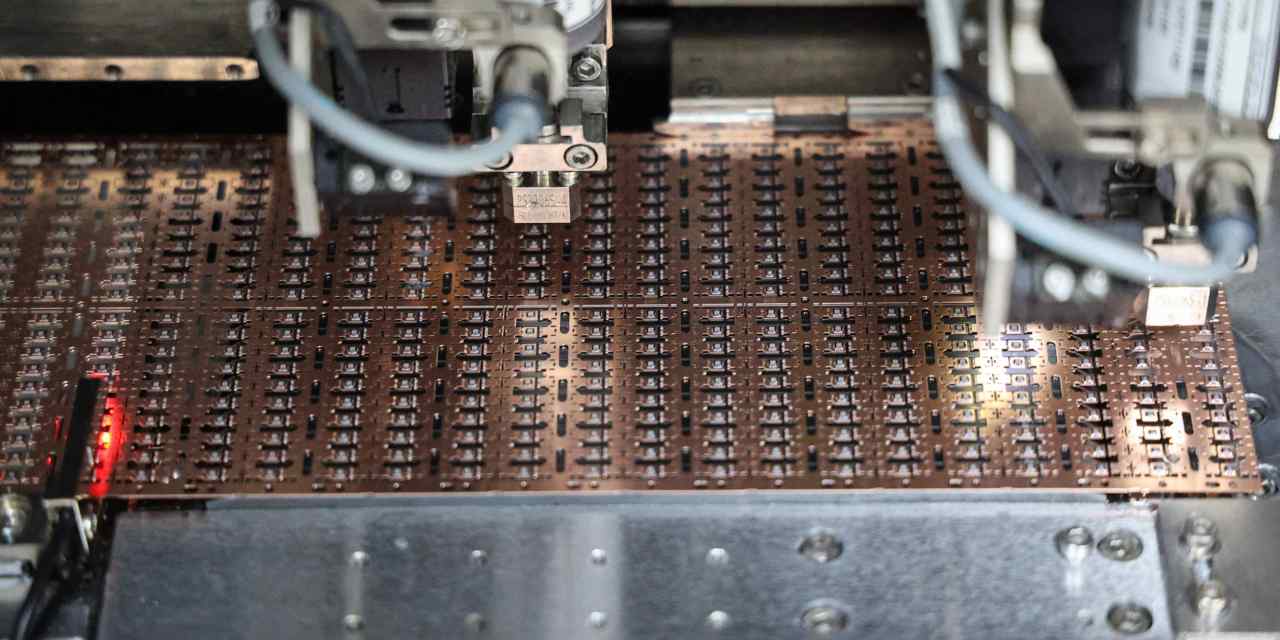

While acknowledging that the market for wafer fabric equipment (WFE) focused on dynamic random access memory chips (DRAMs) is likely to marginally exceed analyst forecasts in 2025, the outlook for next year, despite ongoing strength in AI, is clouded by several factors.

While Wall Street projects an increase in hyperscaler capex — investment in large-scale cloud computing services — that rate of growth is set to slow markedly. This in turn leads to lower investment in additional high bandwidth memory wafer capacity. This persuades the Jefferies’ team to model a 16% decline in DRAM WFE spend in 2026, affecting both ASML and ASM whose DRAM order backlogs will shrink accordingly.

The potential downside relates to weakness in China sales where the U.S. government could tighten semiconductor production equipment restrictions, as part of the ongoing trade disputes between the two countries centered on strategic technology issues. An overall decline of 16% China WFE for 2025, followed by a further 8% in 2026 will probably generate another down year for ASML and ASM revenues in China, they say.