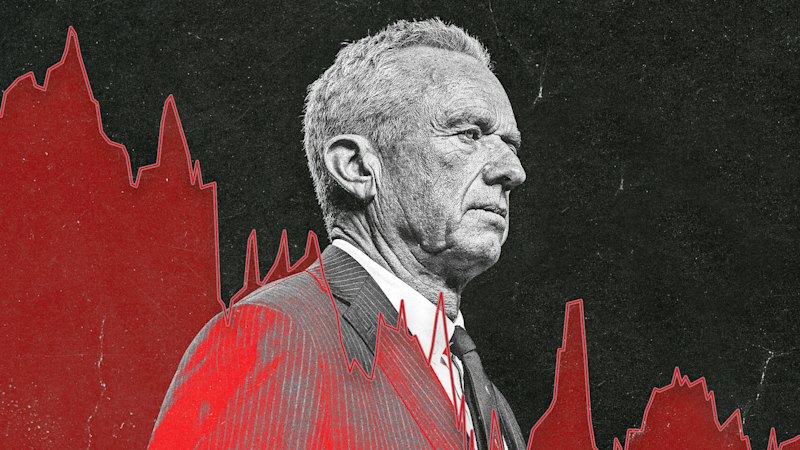

Investors are increasingly worried that having a renowned anti-vaxxer in charge of America’s health system can’t be healthy for a company that wants to grow its vaccine business.

Part of CSL’s share underperformance is the company’s vulnerability to the Trump tariffs. Yet when the dust has settled on the import levies, it may well be that they will affect CSL’s profitability only marginally, given two-thirds of its products are actually made in the US.

The more sinister danger comes from the spectre of US vaccination fatigue or scepticism in the community – something which is being turbocharged by Kennedy. This is more onerous because a fear of vaccination entering the US zeitgeist is difficult to combat.

CSL’s subsidiary Seqirus′ flu vaccine business makes up about 8 per cent of the Australian biotech’s revenue and about 10 per cent of its earnings.