By Holly Williams

The owner of Southern Water has pumped another £1.2 billion into the struggling utility to help boost its finances.

Australian investment firm Macquarie – which previously owned Thames Water – has stumped up the fresh equity, starting with an initial £655 million with a further £545 million due by December.

The plans come as part of a deal that will also see the debt owed to Southern Water’s holding company lenders slashed by more than half.

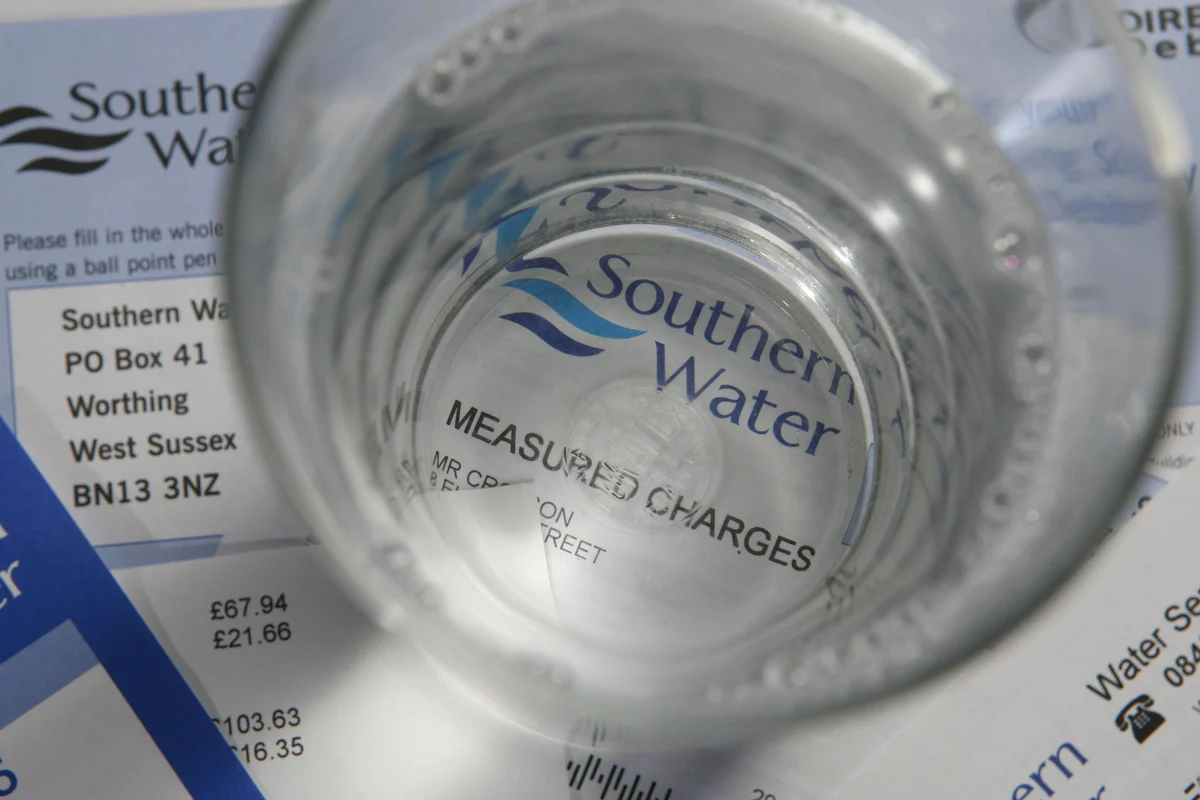

Southern Water, which supplies 4.7 million people across the south and south-east of England, has amassed nearly £9 billion of debt – making it one of the most heavily indebted water firms in the UK behind Thames Water.

It has seen its credit rating downgraded amid fears that it may break the conditions of its lending agreements.

But the firm’s lenders have agreed to write down debt under the latest support package, reducing it debt mounting from £865 million to £415 million.

Lawrence Gosden, chief executive of Southern Water, said: “Every penny of this equity raise will go directly towards delivering the largest growth investment programme in the sector relative to its size, for the benefit of our customers and the environment.

“This follows £1.65 billion of equity already invested by Macquarie, since 2021.

“Taken together with the reduction in debt, and no forecast dividends for the 2025-30 regulatory period, the new investment will directly support Southern Water’s financial resilience and improving performance.”