By Editor Harry Wise

Services industry grows at fastest rate for 10 months as cost pressures ease

The S&P Global UK services PMI survey gave the industry a score of 52.8

By HARRY WISE

Updated: 13:46 BST, 3 July 2025

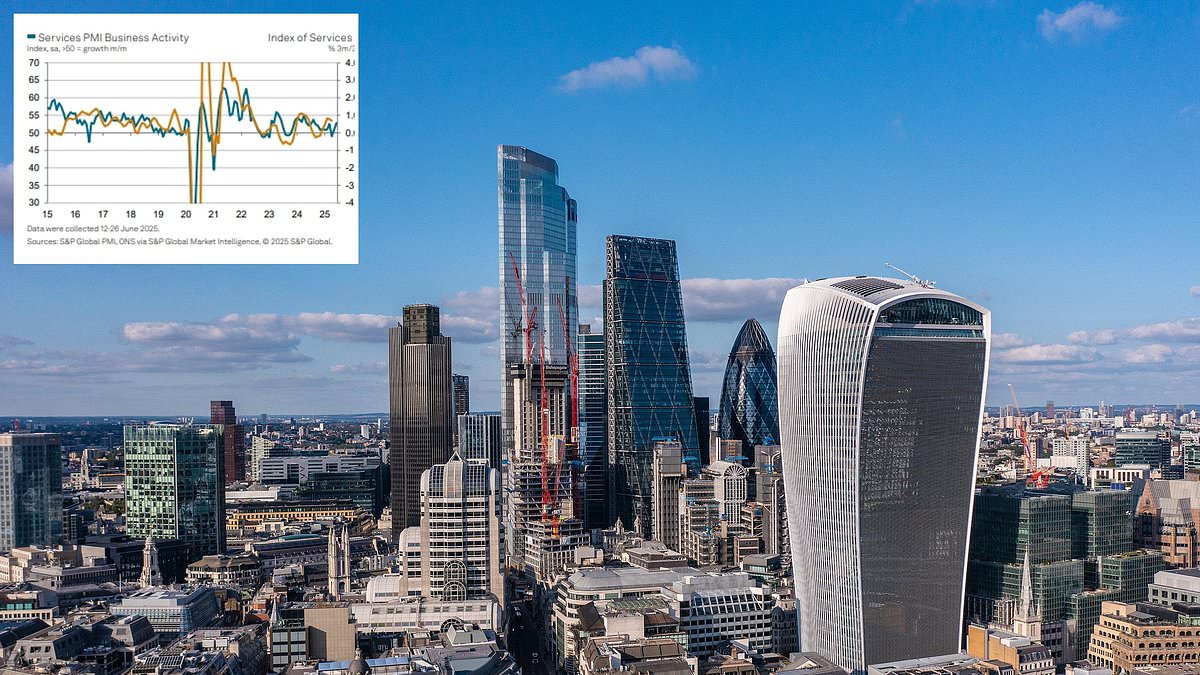

The UK’s services sector expanded at its quickest rate for 10 months in June, as inflation pressures eased.

The closely-watched S&P Global UK Services Purchasing Managers’ Index report gave the industry a score of 52.8 for June, the best figure since August 2024 and above analyst forecasts of 51.3.

Any number above 50 indicates the sector is growing, while any figure below denotes contraction.

Companies surveyed said their output benefited from higher organic sales, ‘generally improving’ business and consumer spending, and marketing and promotional activity.

Overall new work gained by service firms rose for the second time this year, although only marginally, while new orders increased at the fastest pace since last November, thanks to domestic demand.

While input price inflation lingered, with 29 per cent of survey participants reporting higher cost burdens, the rate of cost inflation was the lowest for six months.

Growth: The UK’s services sector expanded at its quickest rate for 10 months in June

However, service employment shrank for the ninth consecutive month, with anecdotal evidence pointing to greater payroll costs and an absence of pressure on business capacity.

In early April, employers’ National Insurance contributions went up from 13.8 per cent on annual salaries above 拢9,100 to 15 per cent on wages exceeding 拢5,000.

The National Living Wage for workers aged 21 and over also went up by around 10 per cent to 拢12.21 per hour.

RELATED ARTICLES

UK manufacturing sector continues to shrink as labour costs… Lotus could axe up to 30% of jobs at Norfolk factory after…

Share this article

Many major UK businesses have warned that the changes, which were originally announced by Chancellor Rachel Reeves in the Autumn Budget, will force them to cut jobs or avoid hiring new people.

Currys boss warns Reeves against further tax hikes as retailer cuts hiring

Tim Moore, economics director at S&P Global Market Intelligence, said the mix of falling employment and abating inflationary pressures ‘leaves the door open’ for the Bank of England (BoE) to cut interest rates next month.

The BoE has reduced the UK base rate, which currently stands at 4.25 per cent, by 0.25 percentage points on four occasions in the past year.

Its governor, Andrew Bailey, told CNBC earlier this week that ‘the path of interest rates will continue to be gradually downwards’.

S&P Global noted that the growth in average prices charged by service sector companies was the smallest in four-and-a-half years.

Thomas Pugh, chief economist at RSM UK, said this ‘will give some ammunition to the doves at the Bank of England, and makes a rate cut in August even more likely’.

DIY INVESTING PLATFORMS

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from 拢4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

Share or comment on this article:

Services industry grows at fastest rate for 10 months as cost pressures ease

Add comment