A person connected to veteran HSBC banker Peter Wong Tung-shun bought a luxury unit in Hong Kong鈥檚 Southern district for HK$125 million (US$15.9 million), as sentiment in the city鈥檚 property market improves gradually.

Two connected units with a total area of 4,616 sq ft were sold for HK$27,080 per square foot to Lion Rock (HK), according to Land Registry records. The property was handed over on Tuesday.

The sole director of Lion Rock, Jeremy Wong Ka-chun, is also one of the three directors of Energy World; the other two are Peter Wong Tung-shun and his wife Camay Wong Ng Kam-mie, according to another Land Registry record.

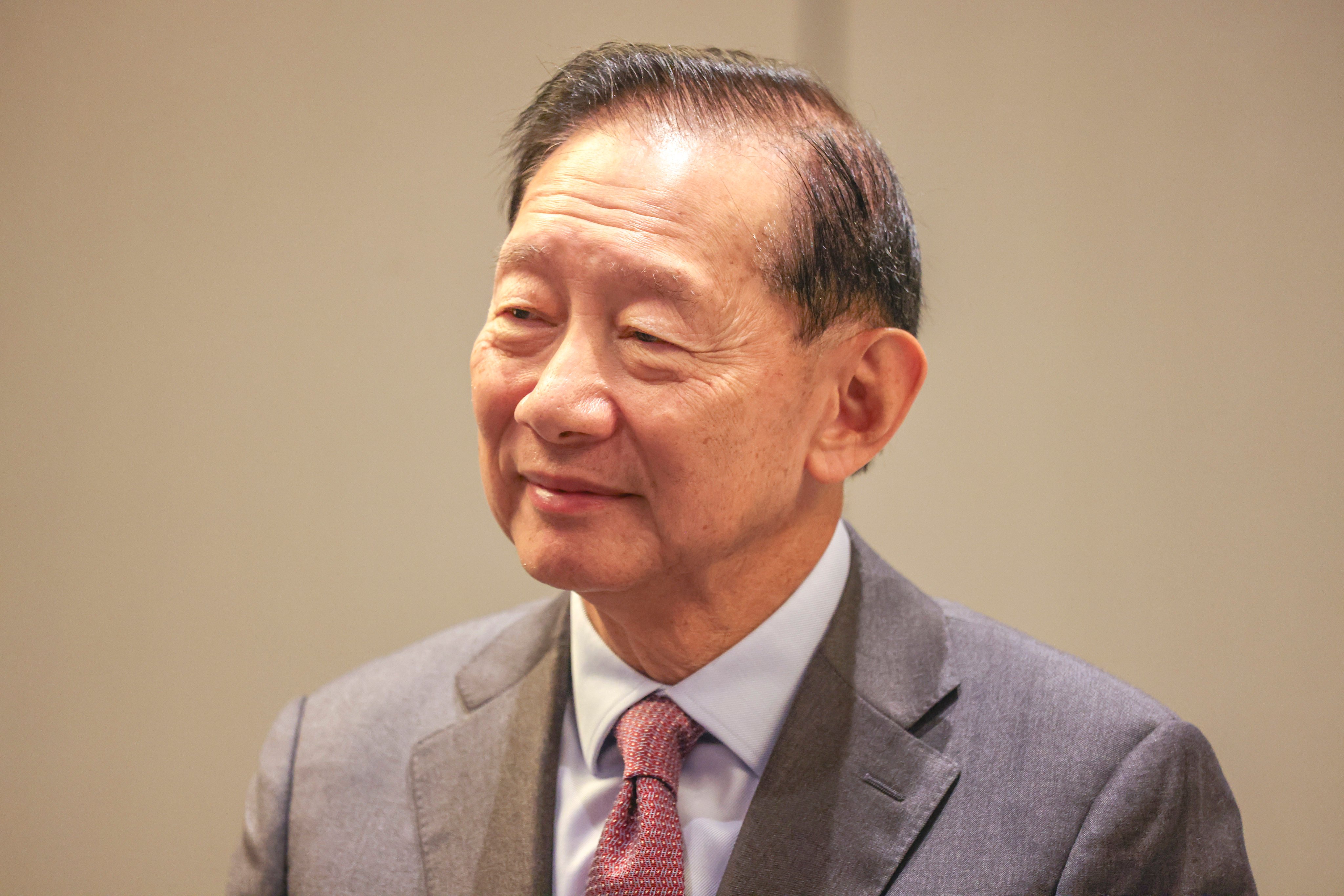

Peter Wong, 73, is the chairman of HSBC Asia-Pacific. HSBC declined to comment.

The transaction came as Hong Kong鈥檚 property market was showing signs of recovery, with lived-in home prices recording a small gain for the second straight month in May, according to official data.

In the first five months of the year, second-hand home prices declined 0.9 per cent. They are down 28 per cent from a peak reached in September 2021.

Celebrities, tycoons and other wealthy investors have been snapping up luxury homes in Hong Kong at low prices.

Earlier this month, Hong Kong pop diva and actress Karen Mok Man-wai bought a flat in Mid-Levels for HK$84.5 million.

According to the Land Registry, a 2,153 sq ft three-bedroom flat at Dynasty Court on Old Peak Road was handed over on June 12 to buyer Karen Joy Morris, which is Mok鈥檚 birth name.

The sister of former Hong Kong chief executive Tung Chee-hwa last month bought a HK$119 million flat in Mid-Levels. The 3,349 sq ft, four-bedroom unit in Grenville House is located at 3 Magazine Gap Road, according to Land Registry records.

In April, Ant Group executive vice-president Shao Xiaofeng and his wife Li Jian bought a four-bedroom, 3,314 sq ft detached house in Villa Rosa, Tai Tam, for HK$78 million, according to property agents. Hangzhou-based Ant Group is the fintech affiliate of Alibaba Group Holding, which owns the Post.

In the first half of 2025, Hong Kong鈥檚 luxury property market experienced increased activity as leveraged sellers sought to unload homes at low prices to raise cash, according to consultancy Knight Frank. This attracted cash-rich buyers, creating opportunities for investors to buy high-value properties at reduced rates.

Knight Frank said it expected a price drop of up to 5 per cent this year for residential homes priced between HK$20 million and HK$40 million, while homes valued over HK$40 million were expected to remain stable.