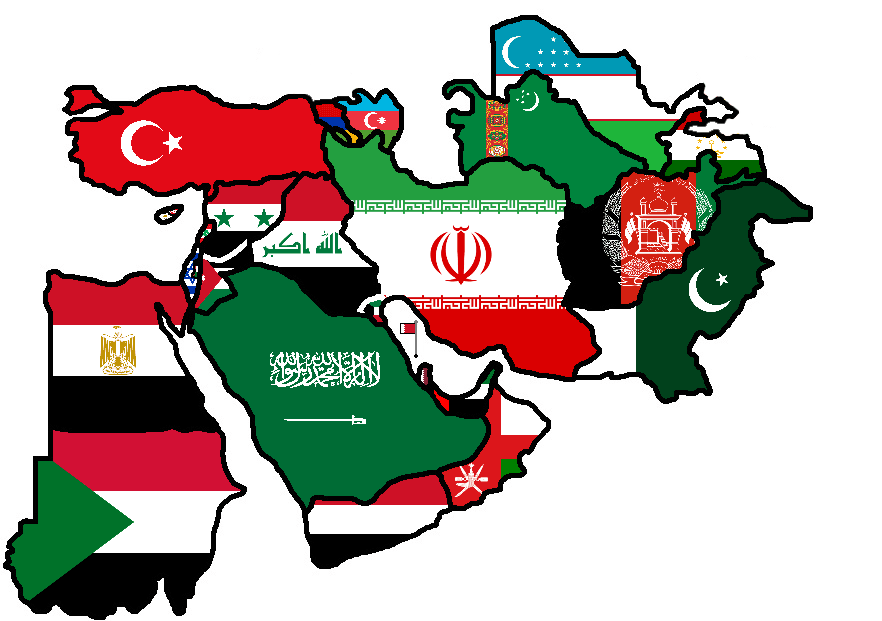

The Middle East in 2025 is a region where the echoes of ancient empires and the ambitions of modern states converge, creating a geopolitical theatre that is as turbulent as it is consequential. From the collapse of the Assad regime in Syria to the fragile ceasefire in Gaza, the region is not just wrestling with its past but actively rewriting its future. Today’s Middle East is a crucible of realignments, rivalries, and reinvention one where the actions of regional and global powers, the logic of trade and supply chains, and the persistence of unresolved conflicts will shape not only regional destinies but global stability itself. “The Middle East is not just shaped by its past, but by the relentless reinvention of its power, alliances, and ambitions.” Historical Fault Lines and Evolving Actors: The Weight of Legacy and the Rise of New Contenders The region’s tensions are deeply rooted in a mosiac of colonial borders, religious schisms, and the legacies of Cold War interventions. The Sunni-Shia divide exemplified by the Saudi-Iranian rivalry remains a central axis, but the landscape is now more crowded and complex. The collapse of the Assad regime in Syria has upended decades-old power balances, forcing Iran to recalibrate its “axis of resistance” and compelling Hezbollah to rethink its strategies in Lebanon and beyond. Meanwhile, the Abraham Accords and the normalization of ties between Israel and several Arab states have created new diplomatic possibilities, even as the Israeli-Palestinian conflict remains unresolved and volatile. “Every conflict in the Middle East is a tapestry woven from history, faith, and the ambitions of outside powers.” The old paradigm of proxy wars is giving way to a multipolar contest where regional actors Turkey, Saudi Arabia, Iran, Israel, and the UAE jockey for influence, often leveraging external powers to further their interests. Lasting stability will require inclusive regional security frameworks that acknowledge both historical grievances and new realities, with external actors acting as facilitators rather than patrons. Strategic Realignments: The New Chessboard of Alliances and Influence The Middle East is witnessing a profound realignment, driven by the recalibration of U.S. engagement, the assertiveness of Russia and China, and the ambitions of regional powers. The U.S., under renewed diplomatic and military engagement, is seeking to broker a Sunni Arab-Israeli bloc to counter Iran, while also managing a delicate d茅tente with Tehran. Russia, emboldened by its role in Syria and deepening ties with Iran, is positioning itself as an indispensable power broker offering arms, energy deals, and diplomatic cover, especially as Western influence appears less certain. China, meanwhile, is leveraging its Belt and Road Initiative and economic heft to secure energy supplies, invest in infrastructure, and mediate between rivals most notably brokering the 2023 Saudi-Iran rapprochement. “The new Middle East is being shaped not by war alone, but by the race to connect continents, control trade, and command technology.” These realignments are not static; they are transactional, pragmatic, and subject to rapid shifts. The growing presence of China and Russia adds complexity, creating a multipolar environment where no single power can dictate outcomes. Regional states must hedge their bets, diversify partnerships, and build resilience into their foreign and economic policies, while global powers should prioritize stability over zero-sum competition. Persistent Conflicts and the Web of Proxy Warfare: Old Battles, New Fronts Despite economic ambitions and diplomatic breakthroughs, the region remains scarred by persistent conflicts. The Israel-Hamas ceasefire is fragile, with Israel likely to maintain a hawkish posture and even accelerate annexation efforts in the West Bank. Hezbollah faces a weakened supply corridor from Iran, raising the risk of new tactics or escalations in Lebanon. Yemen’s Houthi rebels, backed by Iran, continue to threaten Red Sea shipping, reminding the world that non-state actors can disrupt global trade and energy flows at will. “In the Middle East, every local conflict can become a global crisis overnight such is the region’s entanglement with the world’s security and economy.” The central scenario for 2025 is one of conflict management, not resolution. Low-level fighting in Gaza and a tenuous truce in Lebanon are likely, with the U.S. and Saudi Arabia working to contain escalation, while Iran seeks to restore deterrence. International efforts must focus on robust conflict management mechanisms, humanitarian support, and gradual confidence-building, recognizing that grand settlements remain elusive. The Influence of Russia, China, Iran, Pakistan, and India: A Multipolar Arena Russia has entrenched itself as a key military and diplomatic actor, particularly in Syria and with Iran, using arms sales, energy diplomacy, and veto power at the UN to shape outcomes. China is the region’s largest trading partner, investing in ports, energy, and digital infrastructure, and positioning itself as a neutral mediator its role in the Saudi-Iran d茅tente is a case in point[4]. Iran remains a master of asymmetric strategy, leveraging proxies and diplomatic patience to outlast adversaries, even as it faces sanctions and domestic unrest. Pakistan maintains security ties with Gulf monarchies and balances relations with Iran and Saudi Arabia, while also seeking investment and remittances for its struggling economy. India is deepening its economic and strategic footprint through energy partnerships, the IMEC corridor, and robust diaspora ties, while carefully navigating the region’s rivalries to safeguard its interests. “The Middle East is now the world’s most contested diplomatic arena where Washington, Moscow, Beijing, Tehran, Islamabad, and New Delhi all seek both influence and insurance.” The interplay of these powers introduces both opportunities for balancing and risks of escalation, as local actors exploit great power competition for leverage. Regional states should institutionalize dialogue platforms that include all major external stakeholders, reducing the risk of miscalculation and fostering cooperative security. Economic Diversification, Trade, and the Supply Chain Rebranding The Gulf Cooperation Council (GCC) economies are pivoting from oil dependence to diversified growth, with non-energy sectors expected to grow 4% in 2025. Saudi Arabia’s Vision 2030 and the UAE’s economic transformation are attracting FDI ($14.4B to UAE, $5.4B to Saudi Arabia in 2024), while Egypt and Morocco lead North Africa’s rebound. The IMEC corridor and Iraq’s Development Road Project symbolize a new era of trade connectivity, aiming to bypass chokepoints like the Strait of Hormuz and Suez Canal. Global supply chain rebranding is underway, as companies seek resilience by diversifying sourcing away from single points of failure a trend accelerated by Red Sea disruptions and the COVID-19 pandemic. “The Middle East is no longer just a source of oil, it is becoming a hub for global trade, logistics, and digital connectivity.” Trade fragmentation and protectionism remain risks, but the region’s strategic location offers a chance to become a linchpin of Eurasian and African commerce. Governments must invest in infrastructure, regulatory reforms, and digital trade facilitation to fully capitalize on supply chain realignment and global shifts. Oil, Energy, and the Global Ripple Effect The region still controls a third of global oil production and nearly half of proven reserves. OPEC+ decisions, the gradual rollback of supply caps, and the volatility of global demand will shape both regional fortunes and global inflation. The risk of disruption whether from conflict or cyberattack remains high, with the Strait of Hormuz as the world’s most critical energy chokepoint. Yet, the region is also investing in renewables, hydrogen, and climate adaptation, seeking to future-proof its economies. “When the Middle East sneezes, the world economy catches a cold energy, trade, and finance are all on the line.” The GCC’s fiscal and monetary policies remain accommodative, but inflationary pressures (especially in housing) and global monetary tightening could test resilience. Diversification, fiscal prudence, and investment in energy transition are essential to buffer against commodity shocks and ensure long-term stability. Private Sector, Innovation, and Social Inclusion: The Next Growth Frontier The World Bank forecasts MENA growth at 2.6% in 2025, with the private sector and innovation as key drivers. While Gulf states lead in FDI and tech investment, much of the region still grapples with bureaucracy, weak institutions, and youth unemployment. Social reforms especially in Saudi Arabia and the UAE are expanding women’s participation and entrepreneurship, but inequality and exclusion remain risks. “A thriving Middle East will be built as much in boardrooms and classrooms as in oilfields and palaces.” The region’s demographic dividend can only be realized through education, labor market reform, and inclusive innovation ecosystems. Governments must double down on education, digital skills, and SME support, while fostering a regulatory environment that rewards risk-taking and inclusion. Future Scenarios: Navigating Uncertainty and Opportunity Scenario 1: Economic Integration and Relative Stability If current trends continue, the Gulf states could anchor a new era of economic cooperation, leveraging trade corridors and tech investment to drive growth. U.S., Chinese, and Russian interests may compete but also stabilize the region through economic interdependence and pragmatic diplomacy. Scenario 2: Escalation and Fragmentation Persistent proxy wars, a major incident in the Strait of Hormuz, or a breakdown in U.S.-Iran or Saudi-Iran d茅tente could trigger regional escalation, disrupt global trade, and plunge oil markets into chaos. Scenario 3: Gradual Political Reform and Social Inclusion If diversification succeeds and social reforms deepen, the region could see a slow but steady rise in prosperity, innovation, and global influence though the risks of inequality and exclusion remain. “The Middle East’s future will be written not just in treaties and pipelines, but in the ability of its societies to adapt, reform, and reconcile.” The most likely path is a hybrid of conflict management and economic transformation, with periodic crises punctuating a slow, uneven march toward stability. The Middle East’s Next Act-A Region That Shapes the World The Middle East is at a pivotal juncture, its future shaped by the interplay of history, power, and innovation. Its evolution from a region defined by conflict and oil to one driven by connectivity, investment, and multipolar diplomacy is underway, but far from assured. The choices made now by leaders, businesses, and societies will shape not only the fate of the region, but the stability and prosperity of the world. “In the Middle East, every shift in alignment, every flare of conflict, and every new partnership sends ripples across the globe. Its future is, in many ways, our own.” The Middle East’s complexity is its greatest challenge and its greatest opportunity. Its next act will be written not just by the powers within, but by the world’s response to its perpetual reinvention. [Major General Dr Dilawar Singh, a Ph.D. with multiple postgraduate degrees, is a seasoned expert with over four decades of experience in military policy formulation and counter-terrorism. He has been the National Director General in the Government of India. With extensive multinational exposure at the policy level, he is the Senior Vice President of the Global Economist Forum, AO, ECOSOC, United Nations. He is serving on numerous corporate boards. He has been regularly contributing deep insights into geostrategy, global economics, military affairs, sports, emerging technologies, and corporate governance.]