By Dr Matthew Partridge

Try 6 issues free

View all Investing

Stocks and Shares

Commodities

Personal Finance

Personal Finance

Personal Finance

Personal Finance

View all Personal Finance

Bank accounts

Credit cards

Latest Magazine Issue

MoneyWeek Glossary

Newsletters

Newsletter sign-up

Manage my newsletters

Latest newsletter

Newsletter sign up

July Premium Bonds winners

£5,000 cash ISA limit

Avoid £23k landlord bill

House prices fall

Stocks and Shares

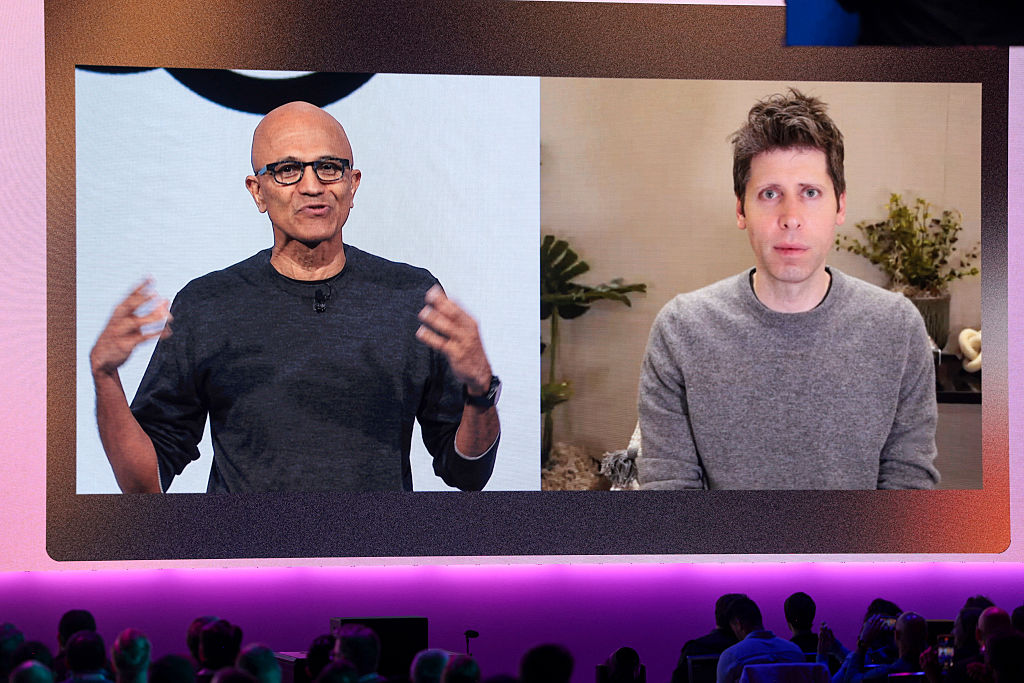

Microsoft’s partnership with OpenAI is on the rocks

Microsoft’s joint venture with OpenAI, the developer of ChatGPT, appears to be in trouble. What now for the two groups?

Newsletter sign up

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

(Image credit: JASON REDMOND/AFP via Getty Images)

Dr Matthew Partridge

2 July 2025

For six years, the alliance between Microsoft and OpenAI, developer of ChatGPT, has been “one of the most successful partnerships in tech history”, says Berber Jin in The Wall Street Journal. Microsoft’s investment provided funding that fuelled OpenAI’s ascendancy in exchange for early access to OpenAI’s technology and nearly half of any profits. But now the relationship may be on the rocks. The two firms are at loggerheads over OpenAI’s $3 billion acquisition of the coding start-up Windsurf, which competes directly with Microsoft. And negotiations over OpenAI’s conversion into a for-profit company have stalled.

Even before this “behind-the-scenes dogfight”, the relationship between Microsoft and OpenAI was “already fraught”, say Bloomberg’s Brody Ford and Shirin Ghaffary. While it has put $14 billion into OpenAI, Microsoft has also backed rival AI start-ups and begun to construct its own AI models. OpenAI, meanwhile, has signed deals with “rival cloud-computing partners and spent much of the past two years building out a suite of paid subscription products for businesses, schools and individuals”.

Who has the advantage: Microsoft or OpenAI?

Experts believe that Microsoft has the upper hand, given how “crucial” converting to a for-profit entity is for the future of OpenAI, says the Financial Times. This is because most of the other investors who have put money into Sam Altman’s company only did so on the condition that they would be able to convert their equity investment into debt, or even ask for it back, if OpenAI failed to change its status. There are rumours that SoftBank, for instance, could cut its $30 billion investment by $10 billion if the conversion is not completed by the end of the year.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Get 6 issues free

Sign up to Money Morning

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Still, OpenAI may have a few tricks of its own if Microsoft refuses its offer of a 33% stake in a restructured unit in exchange for foregoing rights to future profits, says Benj Edwads in Ars Technica. One of these is the “nuclear option” of seeking a federal regulatory review of the terms of its contract with Microsoft for potential antitrust law violations. In that case, OpenAI is likely to argue that “Microsoft is using its dominant position in cloud services and contractual leverage to suppress competition”.

OpenAI has several potential “sweeteners”, such as extending Microsoft’s exclusivity to OpenAI’s technology, or discounting access to new models, says Karen Kwok for Breakingviews. It could also give Microsoft a new class of shares that would give it outsized control, although this might be unpopular with other investors.

But if nothing else works, then OpenAI might be forced to scale back plans for developing new products, as it is currently “incinerating cash”. This would in turn “send ripples through the wider market, where investors have rushed into over $120 billion of generative AI start-up fundraising since 2023”. While this might not matter if AI becomes commoditised anyway, it would at least calm AI “mania”.

This article was first published in MoneyWeek’s magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Explore More

Sign up for MoneyWeek’s newsletters

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Contact me with news and offers from other Future brandsReceive email from us on behalf of our trusted partners or sponsorsBy submitting your information you agree to the Terms & Conditions and Privacy Policy and are aged 16 or over.

Dr Matthew Partridge

Social Links Navigation

Shares editor, MoneyWeek

Matthew graduated from the University of Durham in 2004; he then gained an MSc, followed by a PhD at the London School of Economics.

He has previously written for a wide range of publications, including the Guardian and the Economist, and also helped to run a newsletter on terrorism. He has spent time at Lehman Brothers, Citigroup and the consultancy Lombard Street Research.

Matthew is the author of Superinvestors: Lessons from the greatest investors in history, published by Harriman House, which has been translated into several languages. His second book, Investing Explained: The Accessible Guide to Building an Investment Portfolio, is published by Kogan Page.

As senior writer, he writes the shares and politics & economics pages, as well as weekly Blowing It and Great Frauds in History columns He also writes a fortnightly reviews page and trading tips, as well as regular cover stories and multi-page investment focus features.

Follow Matthew on Twitter: @DrMatthewPartri

Aim has missed its target – will it recover?

Aim, London’s junior stock market, has become less appealing to investors amid scandals and an upcoming inheritance tax blow next April. Will it make a turnaround?

Government launches full review of parental leave and pay – what could it mean for you?

The government wants parental leave to be fairer – will its shake-up fix the widespread problem for families?

You might also like

Carson Block on short-selling and what investors should watch out for when going long

Renowned short seller Carson Block talks to Matthew Partridge about his specialism and where to go long

Drinks maker Diageo gets back on its feet – should you invest?

Diageo has faced one disaster after another over the past two years. Is it finally time to buy?

Airtel Africa is dialling the right numbers – should you buy?

Mobile phone services group Airtel Africa is inexpensive and growing fast

Vietnam: a high-growth market going cheap

The threat of tariffs has shaken Vietnamese stocks, but long-term prospects remain solid, says Max King

Unilever braces for inflation amid tariff uncertainty – what does it mean for investors?

Consumer-goods giant Unilever has made steady progress simplifying its operations. Will tariffs now cause turbulence?

Prosus to buy Just Eat for €4.1 billion as takeaway boom fades

Food-delivery platform Just Eat has been gobbled up by a Dutch rival. Now there could be further consolidation in the sector

Filtronic: A British stock reaching for the stars

British stock Filtronic’s explosive growth is only just getting started

China’s DeepSeek AI is a ‘Sputnik moment’ for the US

The US is facing a new “Sputnik moment” with the sudden appearance of China’s DeepSeek AI firm wiping $1 trillion off the value of US tech stocks.

View More \25b8

Useful links

Subscribe to MoneyWeek

Get the MoneyWeek newsletter

Latest Issue

Financial glossary

MoneyWeek Wealth Summit

Money Masterclass

Most Popular

Best savings accounts

Where will house prices go?

Contact Future’s experts

Terms and Conditions

Privacy Policy

Cookie Policy

Advertise with us

Moneyweek is part of Future plc, an international media group and leading digital publisher. Visit our corporate site.

Future Publishing Limited Quay House, The Ambury,

BA1 1UA. All rights reserved. England and Wales company registration number 2008885.