KARACHI: Digital payments continued to show robust growth, reaching 2 billion transactions and accounting for 89 percent of total retail payments during the third quarter of FY25.

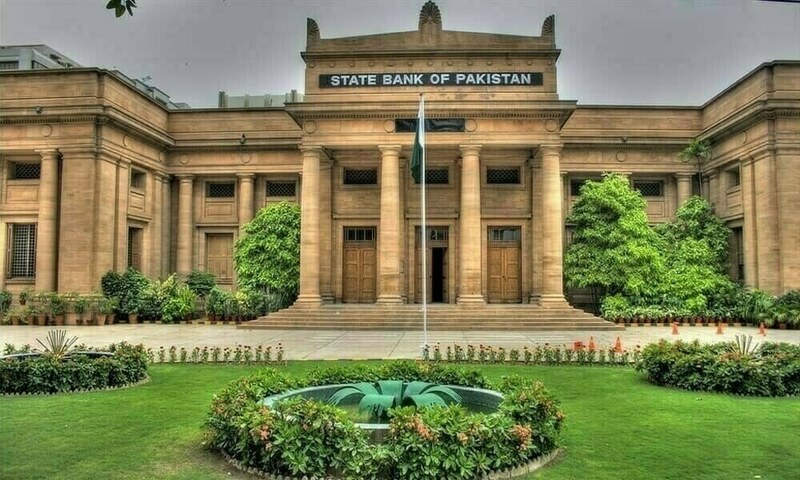

The State Bank of Pakistan (SBP) on Wednesday released its Quarterly Payment Systems Review for Q3 FY25, providing summary on the payment systems, and presenting notable changes in the digital payment landscape of the country.

The digital payments in the country continued its upward trajectory during Q3-FY25, with substantial increase in transactional volume and value. Digital payments crossed 2 billion mark this quarter, with its share reaching to 89 percent in total retail payments.

Digital payments: Pakistan PM forms three high-powered panels

Whereas, 267 million transactions were processed on Over-the-Counter (OTC) channels, accounting for the remaining 11 percent share in retail payments. In terms of value of transactions, digital payments accounted for only 29 percent or Rs 48 trillion of the retail payments, while 71 percent Rs 117 trillion were made through OTC channels including banks branches and branchless banking agents.

Retail payment volumes climbed 12 percent to reach 2,408 million transactions, while the overall transaction value grew by 8 percent to Rs 164 trillion. Further, number of transactions through digital channels accounted for 89 percent of all retail transactions.

Mobile app-based platforms, including mobile banking apps, branchless banking (BB) wallets, and e-money wallets, collectively processed 1,686 million transactions valuing Rs 27 trillion, reflecting a 16 percent growth in volume and a 22 percent surge in value.

Users of these apps conveniently transfer funds and pay bills without the need of going to a bank branch or an agent. The number of banks’ mobile app banking users have increased to 22.6 million up by 7 percent, while users of mobile app-based wallets of BBs and EMIs have increased to 68.5 million rose by 6 percent and 5.3 million, up by 12 respectively during the quarter.

The number of users of digital banking services also witnessed a steady rise. Mobile banking app users grew to 22.6 million, up by 7 percent, e-Money and BB wallet users increased to 5.3 million, up by 12percent and 68.5 million increased by 6percent respectively, while with 7 percent growth, internet banking users reached 14.1 million.

E-commerce payments increased by 40percent in volume to 213 million and 34percent by value to PKR 258 billion, as compared to the previous quarter. Digital wallets were the largest contributor in e-commerce payments i.e. 94percent (199.1 million) by value, while card-based online payments accounted only 6percent (13.5 million) only.

For in-store purchases, 140,861 merchants processed 99 million (up 12percent) transactions of PKR 550 billion (up by 8percent) using a network of 179,383 point-of-sales terminals. Further, merchants accepting QR codes also processed 21.7 million transactions valued at PKR 61 billion.

The SBP operated payment systems, Raast (Instant Payment System) and RTGS (Real-time Gross Settlement System) have been instrumental in accelerating digital payments. Raast processed 371 million transactions worth PKR 8.5 trillion during the quarter, bringing cumulative volumes since launch to 1.5 billion in volume and more than PKR 34 trillion in value. Large-value payments via RTGS handled 1.5 million large-value payments amounting PKR 347 trillion.

The shift towards a digital economy is well-supported by SBP’s strategic initiatives as well as the concerted efforts of banks, fintechs, and payment service providers. As digital payments expand, the SBP remains dedicated to promoting financial inclusion and improving payment efficiency for all stakeholders.

Copyright Business Recorder, 2025