By June Xia Mandy Zuo

In addressing the price wars plaguing many industries in China, the country’s top leadership has resorted to a phrase rarely seen at a high-level meeting, saying that enterprises’ “disorderly low-price competition” needs to be regulated.

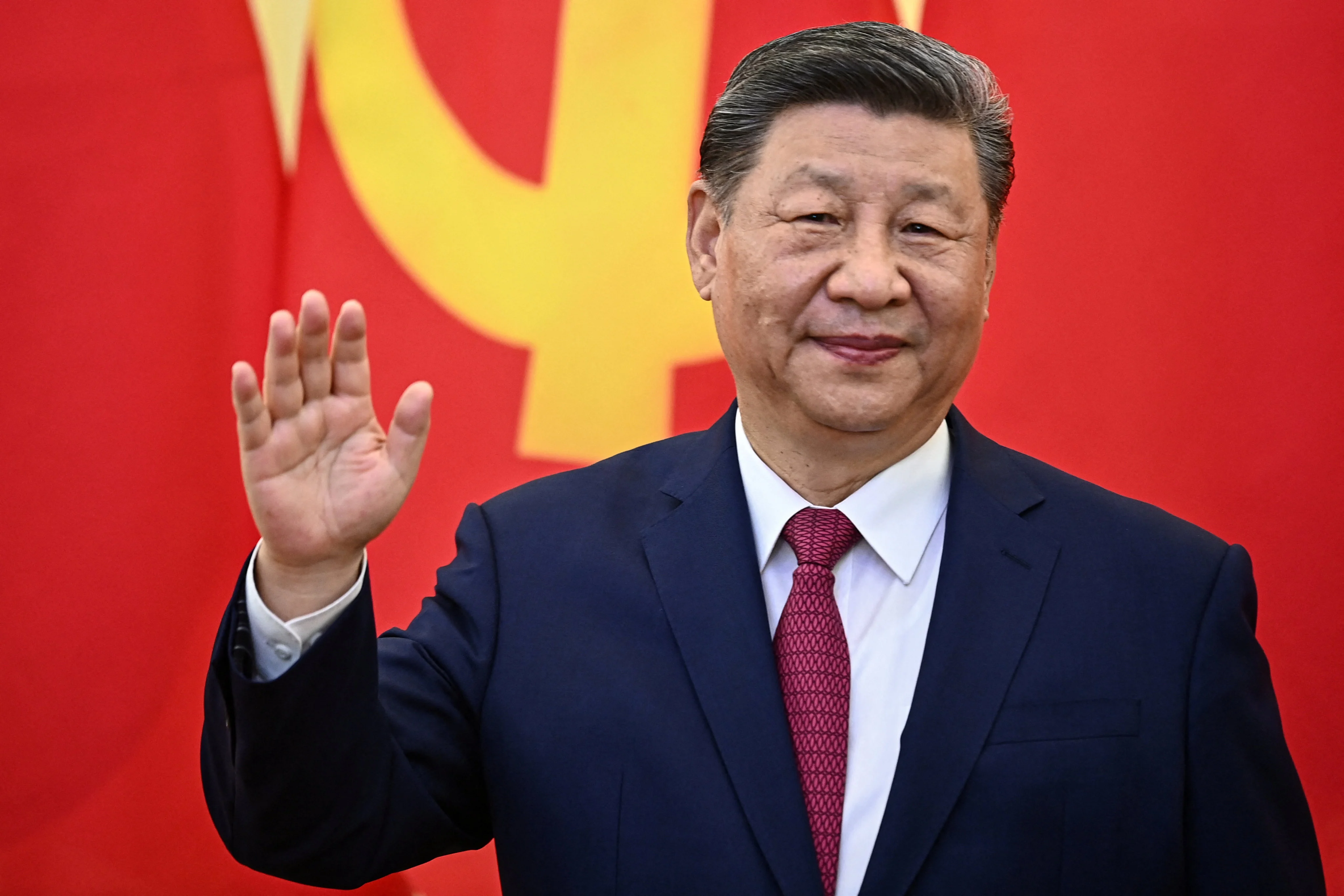

Speaking at a top-level economic meeting on Tuesday, President Xi Jinping used that phrase to explicitly characterise the much-debated phenomenon, in stark contrast to officials who have, since late last year, favoured the vaguer term “involutionary competition” when discussing the problem.

China needs to “lawfully regulate enterprises’ disorderly low-price competition, guide companies to improve product quality, and promote the orderly exit of outdated production capacity”, Xi urged at a meeting of the Central Financial and Economic Affairs Commission, the Communist Party body that supervises economic matters.

Beijing sees tackling such competition as crucial for the health of the world’s second-largest economy as it harms innovation, lowers efficiency and hinders industrial upgrading and product quality improvement.

Compared with “involutionary competition”, which was broader and potentially involved technology, talent and other areas, “disorderly low-price competition” was more focused on price wars and market behaviour – and especially on enterprises suppressing prices to capture market share – said Hou Xuchao, founding partner of China Insights Consultancy.

Xi’s description is reminiscent of the crackdown on China’s internet industry in 2020 and 2021, when it was criticised for having seen a “disorderly” expansion of capital as authorities targeted major tech firms’ unchecked growth and monopolistic practices.

The vicious competition within China in recent years is threatening the domestic industrial ecosystem and complicating China’s economic outlook amid a trade war with the United States and an uncertain international environment, researchers and industry insiders said.

“The low-price battle has become pretty brutal,” said Cao Lei, the 44-year-old owner of Hebei Zhongjing, a company that makes rebar couplers.

“In the steel industry, some low-end products are facing weak demand and huge inventory pressure, so some manufacturers are selling at cost or even taking a loss. Online platforms are bleeding money with subsidies just to keep traffic and hold onto customers.”

Cao said the phenomenon stemmed from a lack of technological innovation and the poor research and development (R&D) capacities of industry players, which meant they could only compete on price.

“The government could step in, but ultimately it’s the market’s call,” he said, adding that when the competition gets too intense, only high-quality players or those with solid R&D and tech strengths will survive.

The auto price war will probably continue for at least another couple of years

Cui Ernan, Gavekal Dragonomics

The price war in the auto industry, driven by oversupply from too many companies and excessive investment, is likely to persist for years due to ongoing funding that will delay market consolidation, Gavekal Dragonomics economist Cui Ernan said in a note issued on Tuesday.

“While the leading automakers are profitable, there is a long tail of struggling firms that should probably exit the market, yet continue to produce thanks to ample government and private-sector financing,” she said.

“This funding support means the market is likely to consolidate only gradually, and the auto price war will probably continue for at least another couple of years.”

Goldman Sachs said in a research note issued on Monday that its onshore clients in Beijing and Shanghai, ranging from mutual funds and private equity funds to asset managers in banks and insurance companies, were concerned about the impact of the auto industry’s price war.

They were also concerned about increased competition between e-commerce giants Meituan and JD, as the latter, known for its low-price strategy, marches into the food delivery business, it said.

The same phenomenon is happening in China’s education and training market. Hua Ruyi, manager of Jiangsu Mingsi Education, said its operations were feeling the squeeze of fierce competition, “something we haven’t seen in the past decade or more”.

“Many customers are avoiding spending altogether, and those who spend are hunting for the cheapest options, comparing multiple providers,” Hua said. “This is making the industry more cutthroat, but everyone in the sector needs to make a living – low prices are the only way to draw in customers.”