By Grace Phiri

Malawi’s growth in business capital has decelerated significantly, from 23 percent in 2017 to just five percent in 2020, amid mounting macroeconomic instability.

Business capital refers to the financial, physical, and intellectual assets that enterprises leverage to drive economic activity, investment, and production. This includes micro, small, and medium enterprises (MSMEs), large corporations, start-ups, industrial capital, and financial capital sources supporting businesses.

The decline, according to the African Development Bank (AfDB) 2025 Country Focus published on Monday, has been due to high inflation, large fiscal and current account deficits, high costs of credit, shortages of foreign currency and vulnerability to climate change and other external shocks.

Consequently, business capital remains a small component of national wealth, accounting for only two percent compared to 15 percent for Sub-Saharan Africa in 2020.

Reads the country report in part: “This limited contribution reflects the dominance of micro and small enterprises engaged primarily in hawking and low-capital activities, which require minimal investment.

“Moreover, many MSMEs find the business start-up costs, access to credit and meeting tax requirements prohibitive.”

According to AfDB, Malawi’s private sector credit to gross domestic product (GDP) is low, at 1.8 percent, compared to South Africa’s 67.6 percent or 12.8 percent for Zambia.

At the same time, Malawi is estimated to have over 1.6 million MSMEs, the majority being microenterprises (74 percent), with operations in agriculture, manufacturing, ICT, and financial services and employing about 80 percent of the total labour force and contributing about 40 percent to GDP.

Ironically, a FinScope Survey of 2022 indicated that only 10 percent of medium enterprises, five percent of small enterprises and three percent of microenterprises have access to credit from commercial banks.

Malawi Union of MSMEs president James Chiutsi said small businesses continue to struggle to access finance amid a tough operating environment.

He said banks in Malawi have not prioritised coming up with product portfolios that favour SMEs because government borrowing has given them steady business.

Said Chiutsi: “Again, most of the banks are not offering development funds to small businesses because once an SME gets a loan from the bank, repayment is after a month.

“But, if we are to develop the sector, we need concessionary risk and ample grace period because businesses take time to develop.”

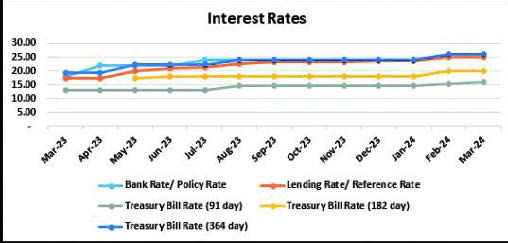

Meanwhile, the Malawi Confederation of Chambers of Commerce and Industry (MCCCI) said with the unchanged policy rate of 26 percent, sustained for 11 consecutive months, signals a tight monetary policy stance aimed at containing inflation.

“For businesses in Malawi, this means that the cost of borrowing remains high, limiting access to affordable credit for investment and expansion,” said MCCCI in its first-quarter economic and business review.

The Malawi Financial Inclusion Strategy (2024-2028) seeks to reduce financial exclusion from 12 percent to five percent to achieve sustainable and inclusive growth and support job creation.

The strategy intends to include all players in the country’s economy with financial inclusion as an essential instrument for increasing agriculture and small enterprises production and eventually increasing household income, reducing poverty, increasing resilience and accelerating economic growth.