BSP Bank Kokopo Branch Manager Kalat Tiriman says Papua New Guineans are missing out on vital financial opportunities because customary land is not yet recognised by banks as a secure asset.

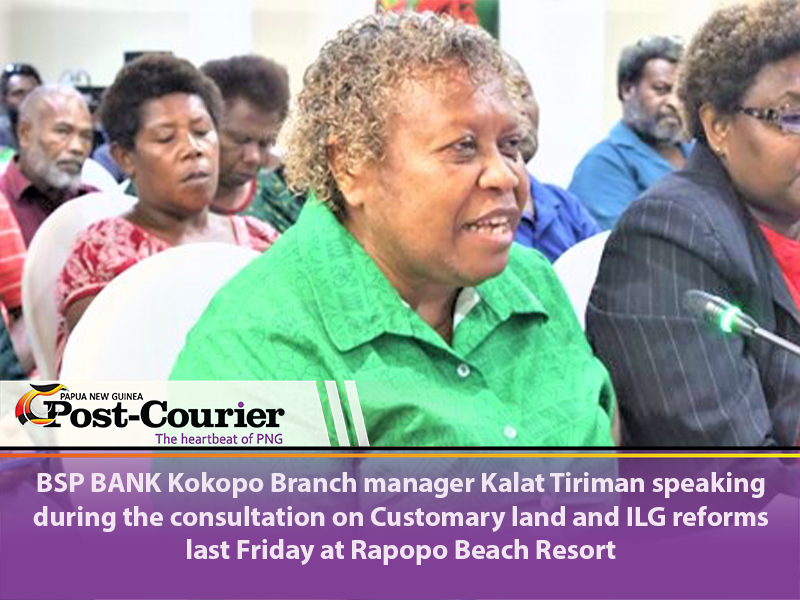

Speaking during a consultation on customary land and ILG (Incorporated Land Group) reforms at Rapopo Beach Resort last Friday, Tiriman explained that the bank currently only accepts state lease land as collateral for loan applications, leaving out the majority of Papua New Guineans who own customary land.

“In most cases, our customers come to the bank seeking home loans,” she said. “We take land as security, but only land that has a state lease. We cannot accept customary land because it’s owned collectively by a group, and that presents too many risks if the borrower defaults.”

Tiriman said BSP is currently assisting clients who own land in titled estate areas like Keravat, Kokopo, Kinabot, Rabaul, Takubar, and Seaview, with the possibility of extending services to Palmalmal in the future.

However, she noted that no applications involving customary titles or Certificates of Customary Ownership (CCOs) have ever been accepted or even seen by her team at the Kokopo branch.

She cited the uncertainty around group ownership and legal enforceability as the main reasons banks reject customary titles.

“If there’s a default, the bank cannot repossess customary land, because it’s not owned by one person. With a state lease, we can easily transfer the title and recover our funds,” she explained.

But Tiriman also welcomed the idea of legal reforms that could create a formal system for customary land ownership one that banks can work with.

“There’s potential if the government sets up an authority under law to register clans as legal entities, and creates a system where land is recorded and titled under the clan name. If that land comes with enforceable conditions like lease terms, rental obligations, and improvement requirements then banks might be more open to lending against it.”

She added that such reforms would not only protect the perpetual ownership of land by customary groups but also unlock economic benefits by giving landowners access to credit for housing or business ventures.

Tiriman’s remarks came as part of a wider discussion led by the Parliamentary Committee on Customary Land and ILG Reforms, which is currently conducting nationwide consultations to gather input from stakeholders and communities.