By Internewscast

With the final increase to the superannuation guarantee now in effect, employers must contribute at least 12 per cent to their employees’ super funds.

Despite this, about one-third of individuals are unaware of where their retirement funds are invested; similarly, many do not know their super balance, and 10 per cent have never reviewed it.

A survey by the Commonwealth Bank involving 3,146 Australians revealed these insights, highlighting that the knowledge gap is particularly prevalent among gen Z and women, standing at 43 per cent.

Jessica Irvine, a personal finance expert at the bank, noted that while people manage their everyday finances well, there is a need for more help in understanding retirement planning options.

What is happening with superannuation?

Thirty-four years ago, former prime minister Paul Keating shared his vision of an Australian future that included a 12 per cent target for compulsory super contributions.

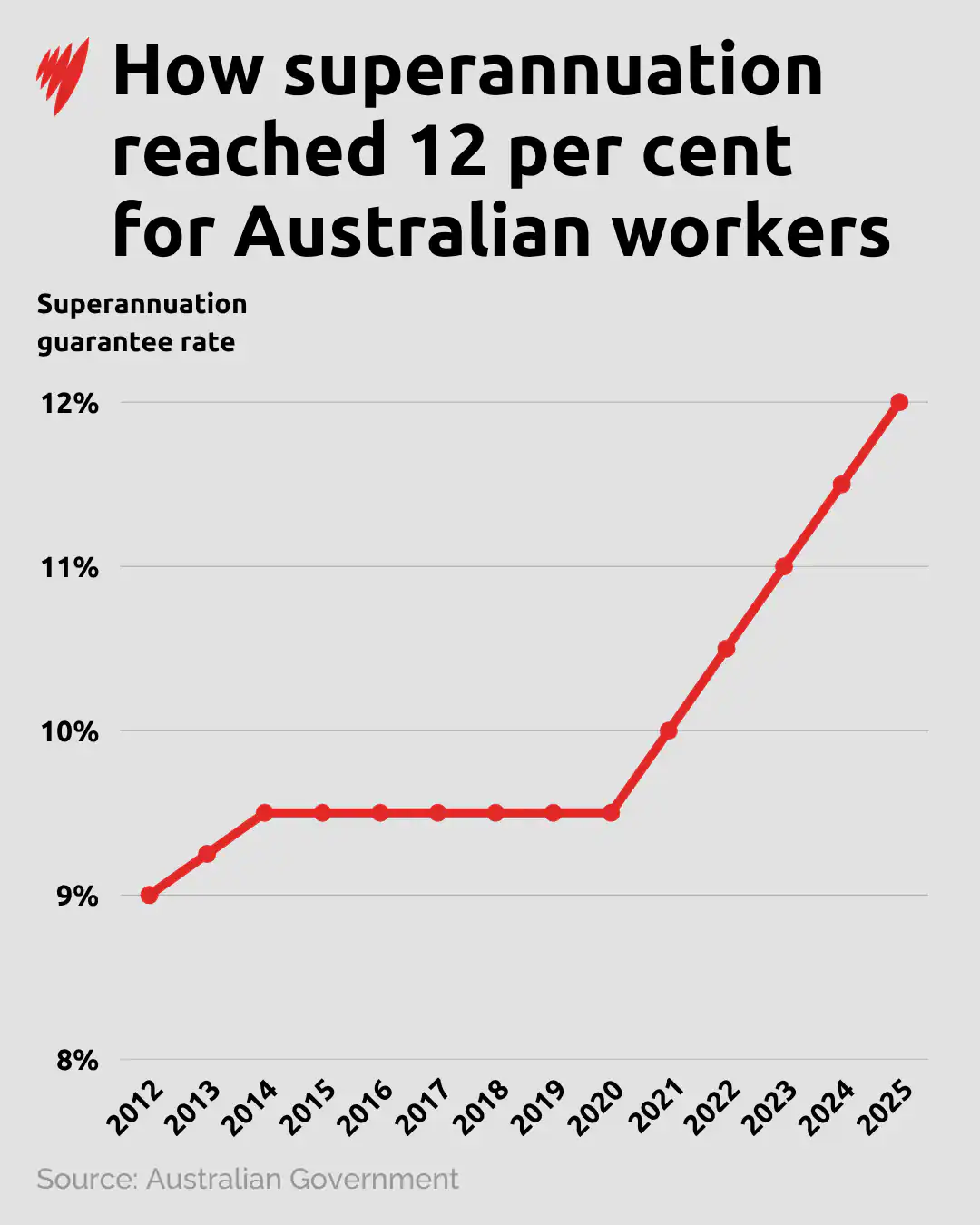

The superannuation guarantee has risen since 2012 to reach 12 per cent.

In a statement to mark the 1 July increase to 12 per cent, Keating said it “will guarantee personal super accumulations in excess of $3 million at retirement” for someone entering the workforce today.

How did we get here?

Superannuation in Australia stretches back to the early 20th century, but there were no attempts to institutionalise universal compulsory contributions before the mid-1980s.

The tribunal sided with the union in 1986 but ruled it as optional — subject to agreement between employers and employees.

Five years later, in Keating’s final federal budget as treasurer, the 3 per cent superannuation guarantee levy was made compulsory.

It came into effect the following year, when Keating was prime minister, with the introduction of a superannuation guarantee charge to penalise employers who don’t meet their contribution obligations.

The mandatory rate then gradually increased to 9 per cent by 2002.

It was supposed to reach 12 per cent by 2000, but, under the Howard government, there were no further increases until 1 July 2013.

In 2010, two years after the Global Financial Crisis and in response to the findings of the Henry Tax Review, then-treasurer Swan unveiled a plan to incrementally lift the superannuation guarantee levy to 12 per cent.

In 2010, then-treasurer Wayne Swan (pictured right) announced a plan to gradually increase the superannuation guarantee levy from 9 per cent to 12 per cent. Source: AAP / Alan Porritt

But two months after it rose to 9.25 per cent in 2013, Tony Abbott stormed to a landslide election victory — and followed through on an election promise to delay increases to the guarantee due to cost pressures on small businesses.

The government failed to legislate the delay the following year, and the rate was lifted to 9.5 per cent — a level it remained at for seven years.

It wasn’t until Australia was in the midst of the COVID-19 pandemic that the incremental increases began.

The 12 per cent milestone

Australia’s superannuation system now manages over $4 trillion in assets, ranking as the fourth-largest pension market in the world.

The 12 per cent milestone is expected to propel Australia to second place within a decade — just behind the United States — despite its relatively small population.

Swan said the superannuation guarantee levy not only delivers a secure retirement for all Australians, but “fundamentally alters the distribution of wealth in our community”.

Swan said he’s “absolutely proud to have been part of this story”.

“I always think of those pioneers, particularly the unionists, who fought to establish this scheme 40 years ago. What it really shows is that ordinary working people can effect change in a society like ours,” he said.

What is a ‘comfortable retirement’?

Swan said while the six-year delay in achieving a 12 per cent increase came at a cost to Australian superannuation balances, the benefits are greater from having finally reached that milestone.

“For someone who’s, say, 30 years old now, it’s going to mean an extra $130,000 in their retirement,” he said.

That follows recent modelling by the Association of Superannuation Funds of Australia (ASFA).

The super peak body’s retirement standard for June 2025 projects a 30-year-old today on the median wage of $75,000 and a $30,000 super balance would witness that figure rise to $610,000 by the retirement age of 67.

Business concerns

There are concerns that a string of 1 July changes, including the increase to the superannuation guarantee levy, could hit businesses and place further pressure on cash flow.

There are concerns that an increase to the superannuation guarantee levy and other changes that took effect on 1 July could negatively impact small businesses and further pressure their cash flow. Source: AAP

“This puts small businesses between a rock and a hard place, needing to either absorb or pass on these costs to consumers,” Achterstraat said.

Beyond 12 per cent: Where to from here?

The 0.5 per cent increase to 12 per cent is the last one legislated by the Australian government.

However, with life expectancy improving, would we need more in our nest egg, and is there a case for raising the superannuation guarantee even further?

“I think there’s going to be a debate about whether we need to go above 12 per cent,” Swan said.

“I think 12 per cent can certainly guarantee quite a dignified retirement for all Australians, but that will be a discussion that will be had in the years ahead.”