By Ally Foster

The image has been shared widely across the internet in recent days, garnering a huge amount of reaction from social media users.

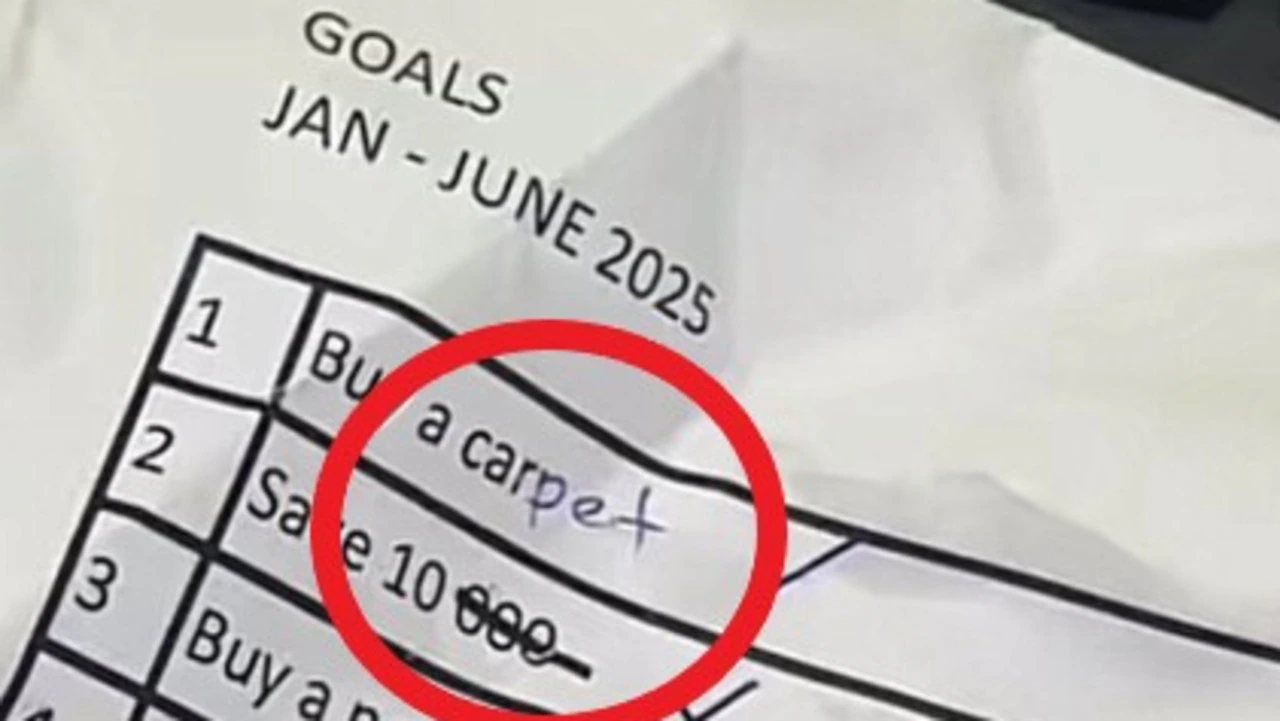

Popular X user, Kuame Oliver, is one of the people who recently shared the photo, which shows a piece of paper titled “Goals. Jan-June 2025”.

On the paper is a list of five goals that have been altered to things that are seemingly more achievable.

The first one, “buy a car”, was changed to “buy a carpet”, and “save $10,000” was changed to “save $10”.

The word “case” was added to the end of the third goal of buying a new phone and number four reading “live a happy life” was changed to simply read “live”.

The last goal, “start my own business”, was tweaked to read “mind my own business”.

The post went completely viral, being viewed more than 23 million times and attracting more than 1500 comments.

While it is clear the photo was meant to be light hearted and satirical in nature, it gave an insight into just how many people are struggling with cost of living pressures this year.

“This is one of the most realistic posts I’ve seen on the internet,” one person said, with another commenter branding the list “very relatable”.

“Gotta keep them goals realistic,” another said, with someone else saying the photo “pretty much sums it up”.

One person noted they too have already had to change their plans for the year after being hit with unexpected financial commitments.

“So brilliant – but I admit that I am bored of having to continuously lower my expectations,” another commenter said.

“My wife says, carpets are too expensive; change it to carrot,” one person joked.

Another added: “Crossing out ‘a happy life’ and just having ‘Live’ took me out cause we just out here barely surviving at this point.”

In Australia, many people are still reeling from the cost of living crisis, despite the consumer price index coming in at 2.1 per cent for May, dropping from 2.4 per cent in the 12 months to April.

Hopes for further rate cuts have also been bolstered after the trimmed mean inflation rate came in at 2.4 per cent, the lowest level since November 2021.

While slowing inflation is positive news, many Aussies are still feeling the pinch as the price of goods and services are still significantly higher than pre-pandemic levels.

Research from financial comparison website, Finder, found there is a growing divide emerging across the country.

According to Finder’s Consumer Sentiment Tracker, the average Australian has $45,475 in cash savings in June – up from $31,179 in June 2023, and a record high since Finder began tracking in 2019.

The amount Aussies are saving each month is also at its highest, now sitting at $932, up from $614 in June 2023 and beating the previous record of $925 in March 2021.

However, there is a significant gap between those on lower combined household incomes and those on higher combined household incomes.

Average households with a combined income of up to $49,000 have just under $16,500 in savings, down from $22,377 in June 2024.

Households with an income over $50,000-$99,999 have an average of $35,263 in cash savings, about $1,100 higher than the previous year.

Those with a combined income of $100,000-$250,00 have an average of $67,463 in savings, up from $51,715 a year ago.

Sarah Megginson, personal finance expert at Finder, said many households are having to dip into their savings to cope with increased costs.

“Even though the rate of inflation might be slowing, the reality is that prices for everyday essentials like groceries, housing, healthcare, and energy are still much higher than they were a year or two ago,” she told news.com.au.

Ms Megginson said while using savings to help with the cost of living might provide some temporary relief for immediate financial stress, it ultimately reduces people’s safety net for the future.

“It’s a really hard time for many Australians because even a block of cheese can be $15, eggs can be over $10 a carton, and just paying for the essentials can wipe you out,” she said.

“Staying really close to your spending and making sure you’re not paying more than you need to on your everyday household bills is a really good way to get some breathing space back in your budget.”