By Brendan Ahern Senior Contributor

KraneShares

Asian equities were largely higher overnight, led by Thailand, Pakistan, and Taiwan, while Japan underperformed and Hong Kong was closed for the Hong Kong Special Administrative Region (SAR) Establishment Day, which marks the handover of the territory to China by the UK following 156 years of colonial rule.

Mainland China opened lower, but grinded higher on good volumes and mixed breadth.

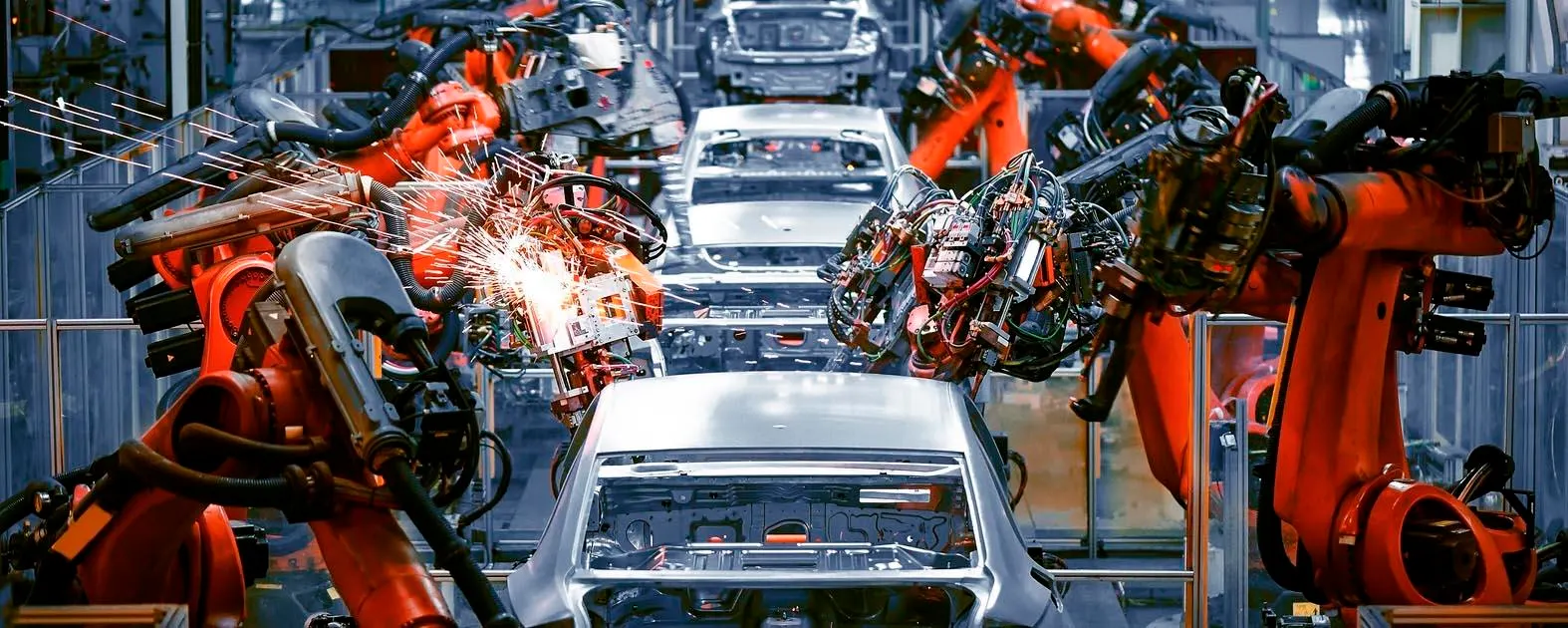

President Xi headed the Central Committee for Financial and Economic Affairs’ sixth meeting, which was focused on several economic areas. The release states the government should “govern the low-price and disorderly competition of enterprises in accordance with laws and regulations” and “promote the orderly exit of backward production capacity”. This is aligned with recent government regulators’ talk on addressing overcapacity in the auto industry. Coincidentally, the China Automobile Dealers Association’s investor warning index increased +3.9% to 56.6%. Levels above 50 indicate auto dealers are holding high levels of inventory, which exposes them to liquidity risk. The statement may also be referencing the recent increase in E-Commerce competition. JD.com entered restaurant delivery and online travel by slashing prices and losing money in order to garner market share.

While execution and implementation of this guidance will be important, it should be cheered by investors as it would raise profit margins. It would also address President Trump’s and the EU’s concerns on excess auto production. The release also referenced growing the marine industry, including offshore wind power, as electricity companies outperformed.

Mainland healthcare stocks outperformed after the National Healthcare Security Administration and National Health Commission released “Several Measures to Support the High-Quality Development of Innovative Drugs”.

Real estate was off, as the China Index Academy announced that year-to-date (YTD) sales through June from the top 100 real estate “enterprises” were RMB 1.8 trillion, which is down -11.8% year-over-year (YoY). June sales were off -18.5% YoY, though improved +1.2% from May. Construction companies underperformed today on the real estate release.

MORE FOR YOU

Banks were higher, as investors are anticipating high dividend payments, based on high balance sheet cash positions.

Aerospace was hit with profit-taking after recent outperformance. Semiconductors and software both underperformed, as well, though I did not see a negative catalyst.

June new energy vehicle (NEV), a category that includes both electric vehicles (EVs) and hybrid electric vehicles, delivery figures were released this morning. The below is courtesy of CnEVPost:

NIO: 24,925 units

Li Auto: 36,279 units, -24% YoY

Zeekr: 43,012 units

XPeng: 34,611 units, +224% YoY

Leapmotor: 48,006 units, +138% YoY

Xiaomi: 25,000 units

Tesla is increasing the price of its Model 3 in China to RMB 285,500 from RMB 275,500. Tesla China also announced the installation of V4 super chargers in several cities.

Today’s anniversary of the turnover of Hong Kong reminds me of how little is taught in the West of the Opium Wars and the colonial powers’ invasion of China. I understand why, as it isn’t that pretty. I did not know very much about it until joining KraneShares, where, out of curiosity, I educated myself by reading several books. I’ve included an image below of the Shanghai International Settlement flag that includes the colonial powers that owned a piece of Shanghai. It is something that might be worth examining as it explains an element of today’s geopolitical tensions.Live Webinar

Join us Thursday, July 10, at 11 am EDT for:

$5 Trillion Humanoid Robotics Opportunity – Capitalizing On The Boom

Please click here to register

New Content

Read our latest article:

KraneShares KOID ETF: Humanoid Robot Rings Nasdaq Opening Bell

Please click here to read

Last Night’s Performance

KraneShares

KraneShares

KraneShares

KraneShares

Last Night’s Exchange Rates, Prices, & Yields

CNY per USD 7.16 versus 7.16 yesterday

CNY per EUR 8.45 versus 8.44 yesterday

Yield on 10-Year Government Bond 1.64% versus 1.65% yesterday

Yield on 10-Year China Development Bank Bond 1.69% versus 1.70% yesterday

Copper Price 0.31%

Steel Price -0.73%

Editorial StandardsReprints & Permissions