By Staff Reporter

A joint operation involving the Civil Guard, National Police, and Mossos d’Esquadra has dismantled a major criminal organization based in Barcelona that defrauded hundreds of people across Spain. Operating out of call centers disguised as legitimate investment firms, the group is believed to have stolen over €10 million since 2022 through a sophisticated and long-running scam.

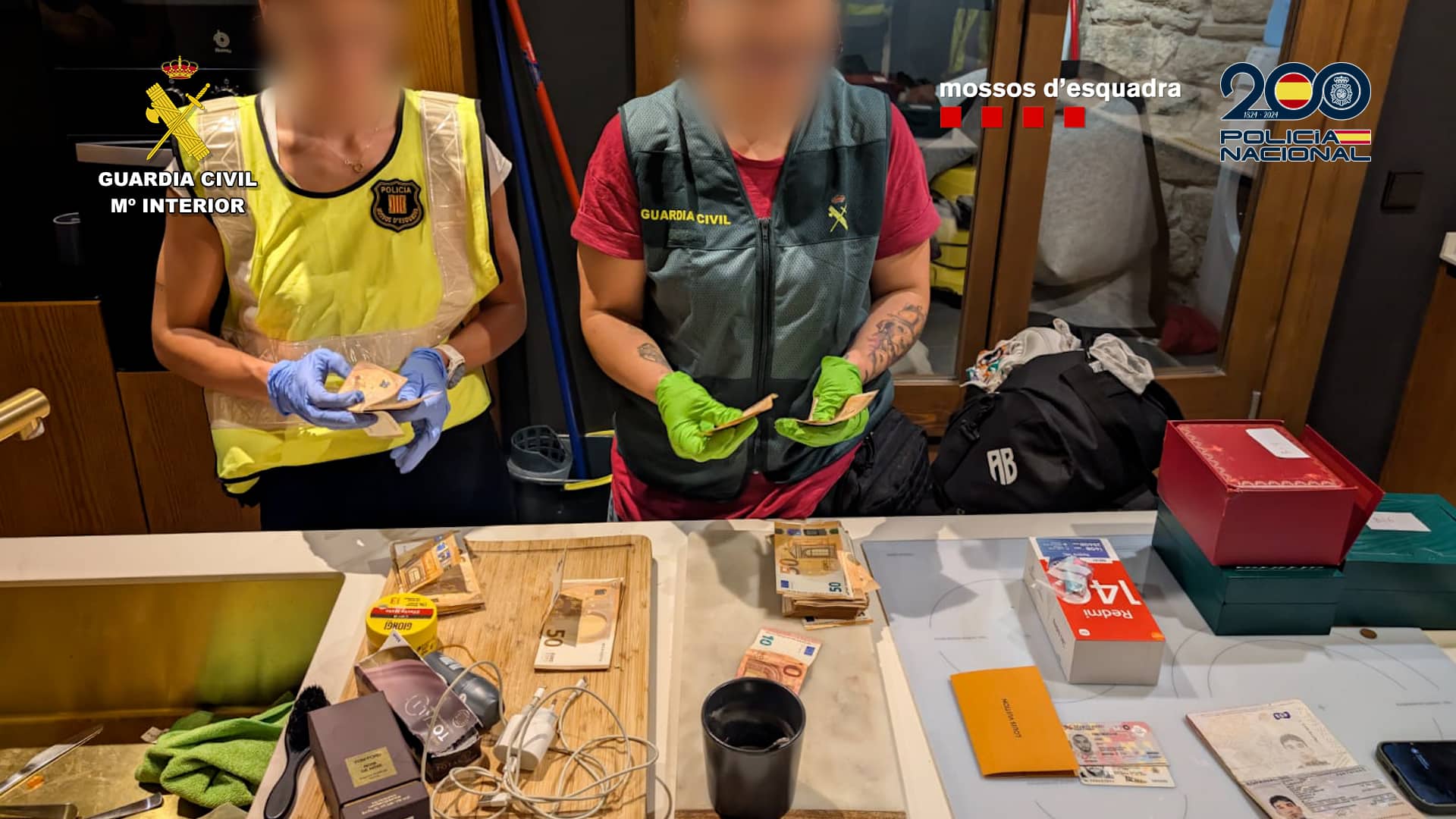

Twenty-one individuals were arrested—seventeen in Barcelona, two in Madrid, one in Mallorca, and one in Alicante. Among them are the three main leaders of the network, who are now in pre-trial detention. Authorities seized seven high-end vehicles, one of which is valued at over €100,000, as well as a firearm, over one million euros in cash, cryptocurrency wallets worth more than €300,000, luxury watches, jewelry, and computer equipment.

Investigators expect the analysis of the seized materials to take months.

The scam involved persuading victims to make fake investments through false advisors, realistic but fraudulent websites, and call centers set up in rented offices. The group advertised on social media and search engines, posing as experts in cryptocurrency and well-known companies to attract victims.

Once contact was made, victims were manipulated into making increasingly large financial transfers, often beginning with small investments and escalating to substantial amounts. In one notable case, a victim lost over €700,000 after being misled for two years.

To reinforce their deception, the group used psychological manipulation to build emotional trust with victims. They employed tactics such as establishing emotional bonds and exploiting personal vulnerabilities to gain deeper access to victims’ finances. In some cases, remote access software was installed on victims’ computers to facilitate fund transfers directly.

Fake trading platforms were used to simulate profits, further encouraging continued investment. If a victim tried to recover their funds, the group would contact them under new company names, demanding additional payments to “unlock” their supposed earnings.

Unlike many scams of this nature, which are often run from abroad, this organization operated entirely within Spain, with locations across Catalonia. They used short-term office rentals to avoid detection and had teams of workers trained to deceive and retain victims. Offices were equipped with modern technology and even panic buttons to instantly shut down operations if police entered the premises.

Authorities warn that this type of organized fraud is increasingly difficult to combat and stress the importance of international cooperation and widespread financial education to prevent future scams.