By Christian Abbott

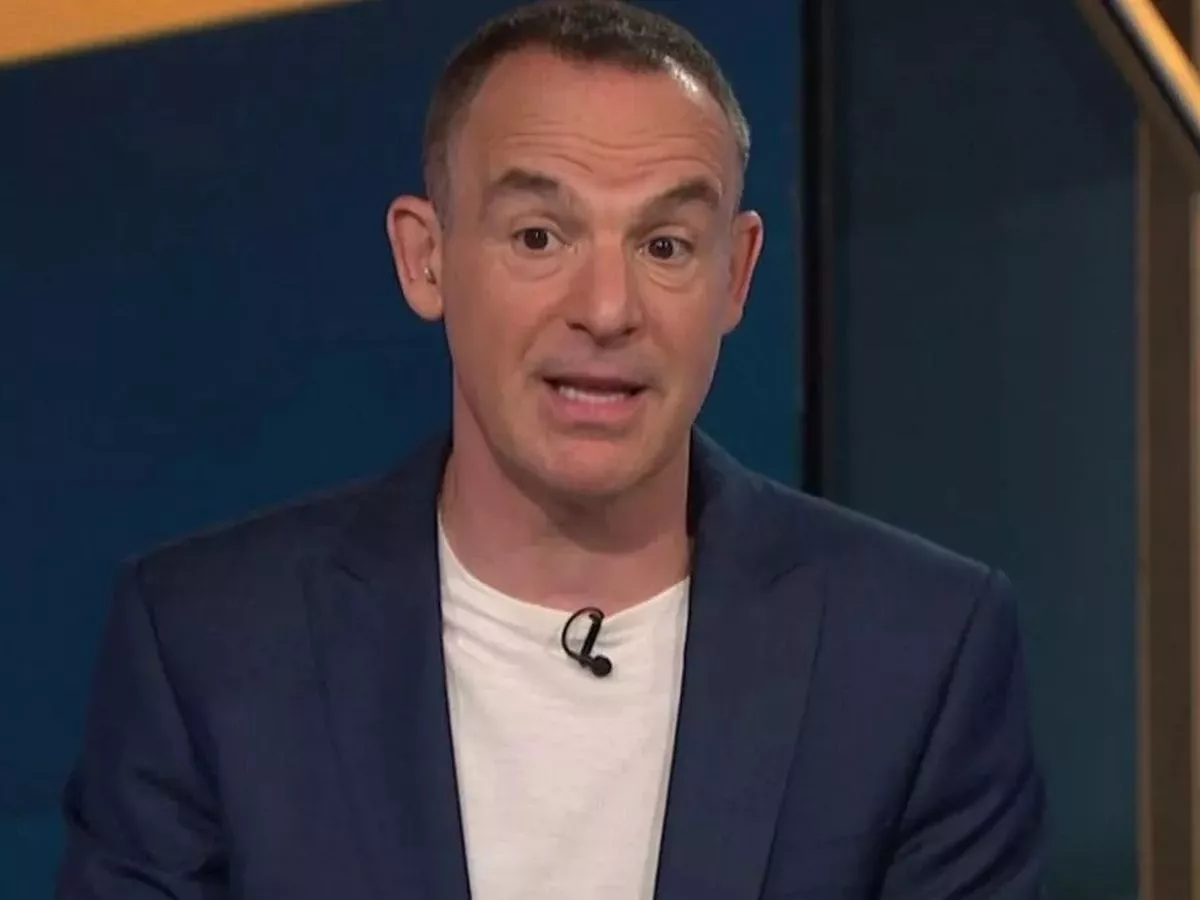

Martin Lewis has wasted no time in slamming recent reports that Chancellor Rachel Reeves is planning to announce a cut to Cash ISA limits. Taking on X, the 52-year-old finance guru wrote: “Reports Rachel Reeves will announce a cut to the cash ISA limit at her July 15 Mansion House speech. If true, I think it’s a mistake. I doubt it’ll substantially nudge people to invest, not save; said to be the aim. This isn’t nudge economics, its p**s people off economics. 鈥淐urrently, you can put 拢20,000 in tax-free ISAs, whether cash (savings) ISAs, shares (investments) ISAs or the smaller types. It’s said the reduction鈥檇 only be for cash ISAs, so people can still invest the same tax-free. Read more: New PIP rules will see ‘millions plunged into hardship’ “NB At this point I should note, it is very likely to only impact future ISA limits (though whether the cut would start this tax year is a big question), so those with money already in cash ISAs shouldn’t panic. “My suspicion is that for many who use cash ISAs, it will just result in them having to pay more tax on their relatively paltry savings interest, not having an epiphany and thinking, ‘Oooh, I’ll just fill up the remainder of my ISA allowance with investments instead’. “Now I should note, I am in favour of encouraging people to invest in the UK. It鈥檚 good for individuals over the longer term and for the economy, especially if a way is found to encourage people to invest in UK firms. Yet this isn鈥檛 the route to do that. “I鈥檒l be disappointed if the Chancellor chooses to listen to the big investment firms in the City, and shut down many building societies and consumer groups who’ve said it’s not a good route. “Instead, let’s start a conversation about how we encourage investments, even possible intervention when people save, to explain other options. “We need to educate, provide better 1-on-1 easy guidance, and start to change the way people think about risk. But let’s use the carrot, not a stick.” There have been reports that Rachel Reeves plans to reduce the Cash ISA limit from 拢20,000 to just 拢4,000. The government is yet to confirm this decision, but a Whitehall source told the Financial Times that negotiations are still ongoing regarding the new cap. Join our dedicated BirminghamLive WhatsApp community for the latest updates sent straight to your phone as they happen. You can also sign up to our Money Saving Newsletter which is sent out daily via email with all the updates you need to know on the cost of living, including DWP and HMRC changes, benefits, payments, banks, bills and shopping discounts. Get the top stories in your inbox to browse through at a time that suits you.